Experience You Can Count On

We speak the language of FIRS — and translate it into results for you.

We’ve helped individuals, freelancers, and businesses navigate Nigeria’s complex tax system. You get local insight and proven results — not guesswork.

Accuracy That Protects You

Because one wrong entry can cost you — we make sure it never does.

One mistake in your filing can lead to penalties or overpayment. Our technology and expert checks make sure every figure is correct, every deadline is met, and every detail aligns with the Tax Act.

Legally Maximize Your Returns

Our goal isn’t just to file your taxes — it’s to keep more money in your pocket.

We claim every legal relief and deduction you qualify for, from pensions, rent, and more — so you keep more of your money, legally.

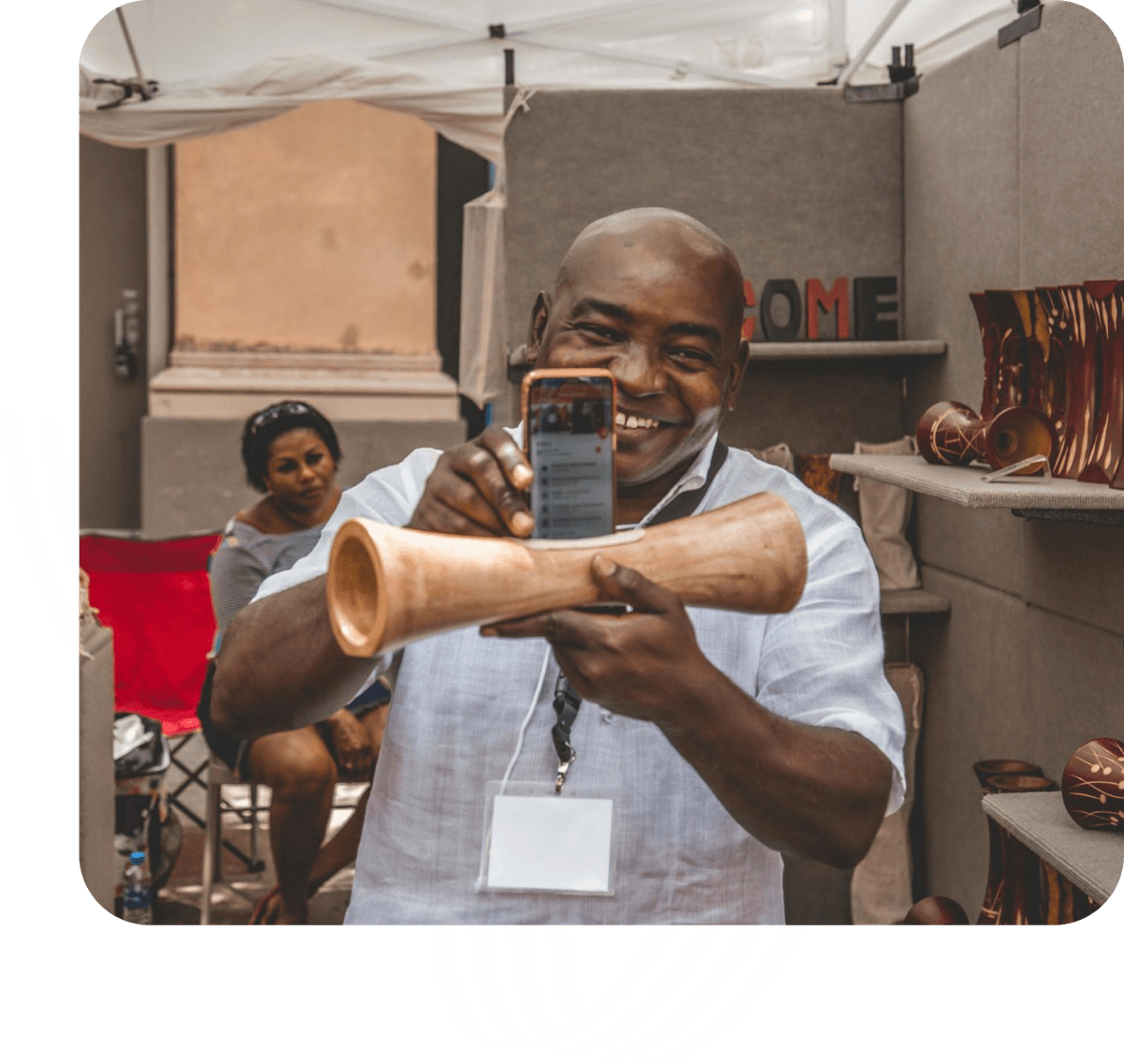

Real Support From Real People

Because good tax support should sound like a conversation, not a lecture.

Our team of Nigerian tax experts is here to help by chat or phone — simple answers, no jargon.

Transparent From Start to Finish

Trust starts with transparency — and we build it into every filing.

You always know what's filed, what data is used, and what you’re paying for. No hidden charges, no inflated numbers.